AutoFi: Redefining the Future of Decentralized Finance

Updated on October 5, 2025

Why AutoFi could give rise to a new age of composable finance on Web3

Redefining the Future of Trading

Imagine you're about to execute a major DeFi trade. You hit "confirm," and in a split second, a bot front-runs your transaction costing you thousands. Frustrating, right? This is the risk with many current protocols, where every millisecond matters. Supra's AutoFi changes the game by making trades fully automated and executed in the same block. Fast, precise, and protected from bots.

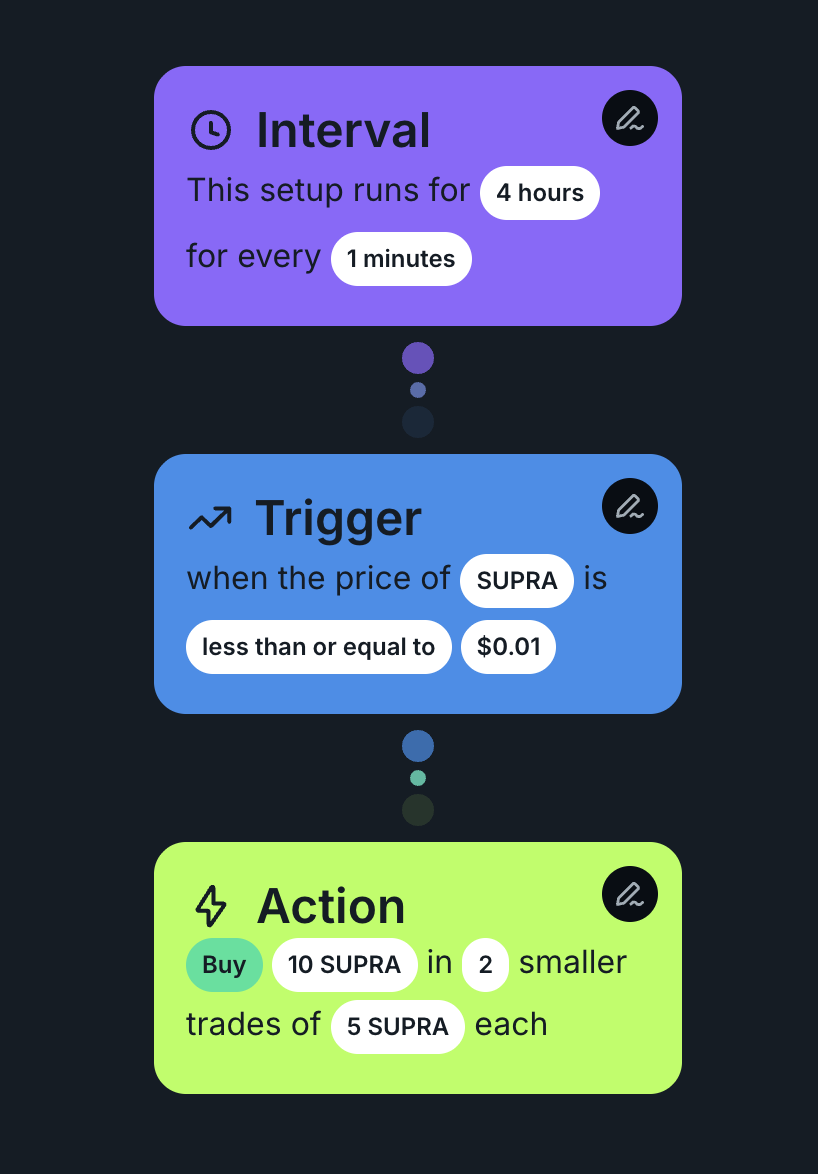

Automated Trades, Same-Block Execution

Note that speed alone isn't enough, the key feature of AutoFi is same-block execution. Simply put: once your trade conditions are met, AutoFi executes the transaction automatically within the same blockchain block. No waiting. No queues. No chance for bots to steal your profit.

Take a typical MEV scenario: Alice wants to swap 100 ETH for a stablecoin on a popular DEX. Normally, a bot spots her pending transaction and jumps ahead, capturing value before her trade executes. With AutoFi, her trade is executed automatically and instantly in the same block, leaving no window for front-running. The result? Trades that are effectively unbeatable in speed and safety, rivaling even sub-millisecond execution in traditional finance.

Trade Using Simple English Commands

But speed and security together isn't enough either, instead of wrestling with complex scripts or multiple steps you can execute trades using plain English commands. For example, you might type, "Swap 50 ETH for USDC if the price is above $1,800", and AutoFi handles the rest automatically. The protocol interprets your instructions, monitors market conditions, and executes your trade in the same block, all without manual intervention. It's like having a personal trading bot that understands exactly what you want, making sophisticated DeFi strategies accessible to everyone. No coding required.

Threshold AI Oracles That Keep Everything in Sync

Now speed, security, and automation combined still isn't enough... you need reliable data to make smart trades. AutoFi integrates the native Supra Threshold AI Oracle service to bring off-chain data directly into smart contracts in real time. Price feeds, market indicators, or even external metrics can be used as triggers for trades or strategies. This ensures your automated actions are always based on the freshest information, eliminating the lag and inaccuracies that plague conventional DeFi setups.

Multi-Chain Execution and the Layer 0 Vision

So speed, security, automation, and AI Oracles together? Now things are getting really interesting. But what if AutoFi isn't just confined to a single blockchain? What if it can carry out transactions for multiple chains and then bridge the results back to the originating blockchain once its execution is complete?

With AutoFi this possible! Think of it like a master coordinator: AutoFi can execute part of a transaction for Ethereum, another part for Solana, and yet another for Binance Smart Chain, all in one smooth operation. Once each step is complete, it reconciles the results back to the original chain. This cross-chain capability is what positions AutoFi as a potential "Layer 0" or "intralayer" protocol. Unlike Layer 1 chains like Ethereum or Solana that focus on their own networks, an intralayer protocol orchestrates multiple blockchains, providing the infrastructure for seamless cross-chain operations. In other words, AutoFi could become the foundational layer connecting blockchains, enabling them to interact as efficiently as transactions within a single chain.

Composable Finance at Its Finest

Beyond speed and cross-chain magic, AutoFi opens a playground for composable finance. Lending, staking, yield farming, or more complex strategies can now operate autonomously. Developers can create applications that respond to real-time market conditions without worrying about latency, off-chain dependencies, or manual oversight. Imagine a portfolio that automatically rebalances itself across multiple chains, adjusts leverage in response to market swings, and executes trades the instant opportunities arise. This all without you lifting a finger and all setup using plain English inputs - no code required! That's the promise of AutoFi.

Why You Should Care

So, why does this matter to you? AutoFi isn't just another DeFi protocol—it's has the potential to become the future of finance. Instant same-block execution protects users from MEV attacks. AI Oracle integration ensures decisions are based on accurate, up-to-date information. Cross-chain execution hints at a truly interoperable blockchain ecosystem. And composable finance allows for sophisticated strategies that were previously impossible or impractical.

AutoFi combines these elements to deliver a protocol that is fast, secure, and extremely flexible. It's the kind of infrastructure that could turn blockchain networks from isolated islands into a connected, efficient, and intelligent financial system. In a way, it's not just redefining DeFi, it's laying the groundwork for what could become the backbone of a new, cross-chain, intralayer for all financial ecosystems.

AutoFi is giving DeFi the speed of traditional finance, the intelligence of automated execution, and the connectivity of cross-chain operations. If decentralized finance has been about removing the gatekeepers, AutoFi is about unleashing AI and automation along with it.